Forex, short for Foreign Exchange, alludes to the worldwide commercial market where currencies are exchanged. It is the biggest monetary market on the planet, with a typical day to day exchanging volume of more than $6 trillion. The forex market permits people, organizations, and governments to trade one currency for another, working with global exchange and venture. In contrast to customary stock trades, the forex market works 24 hours daily across various time regions, making it a decentralized and an ever open market.

How Forex Functions

The forex market works through the trading of currency pairs. In every transaction, one currency is traded for another, and the cost of one cash is determined comparative with the other. For instance, in the USD/INR pair, the U.S. Dollar (USD) is exchanged against the Indian Rupee (INR), and the exchange rate demonstrates the amount one dollar is worth in rupees.

Currencies are always exchanged in pairs, as the worth of one Currency has to be relative with another. Probably the most exchanged currency pairs include:

EUR/USD – Euro against the U.S. Dollar

USD/JPY – U.S. Dollar against the Japanese Yen

GBP/USD – English Pound against the U.S. Dollar

Members in the Forex Market

Different sorts of members’ work in the forex market, each with various purposes:

- Central Banks and Governments: They utilize the forex market to deal with their nations’ currency reserves and to execute Currency related planning. National banks might mediate in the market to balance out or impact the worth of their Currency.

- Commercial Banks: Huge monetary institutions participate in forex exchange for the benefit of themselves or their clients, including companies and governments. They work with large-scale cash transaction that are required for worldwide exchange and investment.

- Organizations and Enterprises: Organizations engaged with imports and export utilize the forex market to convert foreign currency for the repayment of labour and products. For instance, an Indian organization importing products from the U.S. may have to trade INR for USD to pay for the products.

- Investors and Traders: People and institutional financial backers participate in forex trading to speculate on Currency price fluctuations. They trade currencies, trying to benefit from changes in exchange rates.

- Mutual funds: Large investment capitals also participate in the forex market, frequently utilizing modern methods to make speculative bets on currency rate fluctuations.

Key Forex Terms

- Currency Pair: A Currency pair compares two currencies, with the base Currency recorded first and the comparing currency in second. For instance, in the USD/INR pair, USD is the base Currency, and INR is the comparing currency.

- Exchange Rate: This is the rate at which one currency can be traded for another. For example, if the USD/INR exchange rate is 83, it implies that 1 U.S. Dollar is worth 83 Indian Rupees.

- Pips: A pip (percentage in point) is the smallest price change in the forex market. Most currency pair are cited to four decimal points, and a pip is the adjustment of the last decimal point. For instance, if the USD/INR moves from 83.00 to 83.01, it has moved one pip.

- Spread: The spread is the difference between the bid (purchase) and ask (sell) price of a Currency pair. It addresses the expense of exchanging and is regularly more widespread for less traded Currency pairs.

- Leverage: Forex exchanging frequently includes leverage, which permits merchants to control larger worth of merchandise with a more modest measure of capital. For instance, with 100:1 leverage, a merchent can control over ₹1,00,000 worth of currency with just ₹1,000.

What Forex Means for the Economy

- Trade and Investment: Exchange rates, not entirely set in stone in the forex market, directly affect global exchange and speculation. A Stronger Currency makes imports less expensive however can make a nation’s commodities more costly on the worldwide market, influencing the exchange rate.

- Inflation: The worth of a country’s Currency comparative with others, impacts inflation. A deteriorating Currency can make imports costlier, prompting higher inflation as the cost of imported products rises. On the other hand, a stronger Currency can assist in reducing inflations by making imports cheaper.

- Tourism and Travel: Exchange rates influence the cost of travelling and the travelling industry. A stronger current makes global travel cheaper for the nation’s residents, while a weaker Currency makes it costlier.

- Foreign Debt: A country with foreign debt might confront greater expenses if by chance its Currency devalues. This is on the grounds that the nation will require greater amount of its own Currency to take care of debt that is denominated in foreign curency.

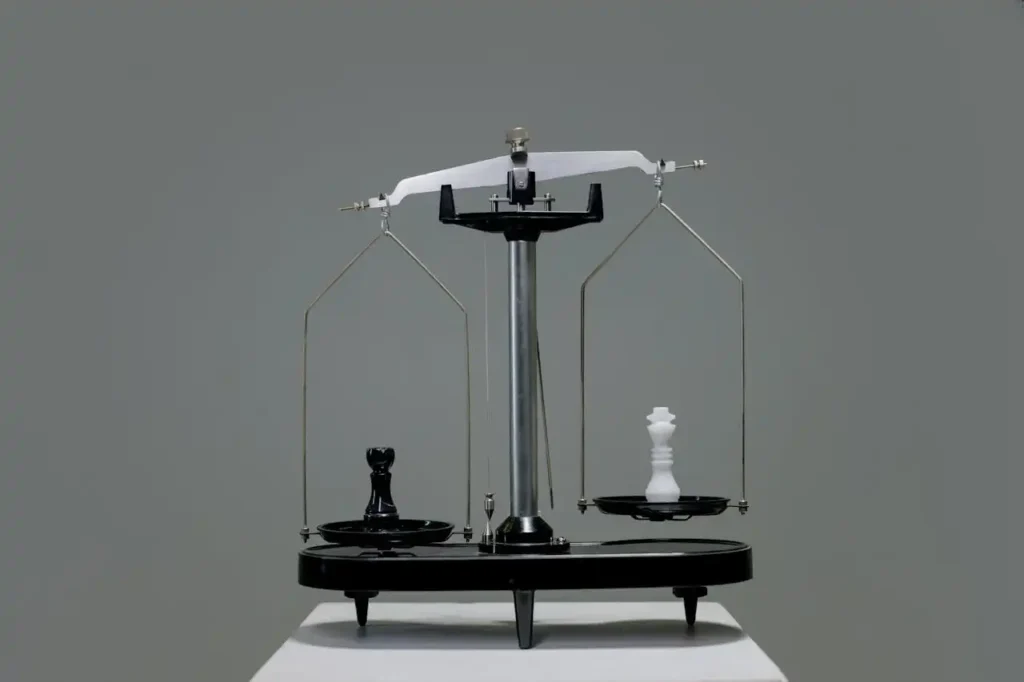

Advantages and Dangers of Forex Exchanging

Benefits:

- Liquidity: The forex market is exceptionally fluid, significant exchanges can be executed rapidly and at low expenses because of the great volume of members.

- 24-Hour Market: In contrast to financial exchanges, forex works 24/5, giving dealers the adaptability to exchange whenever.

- Influence: Forex permits brokers to utilize influence, which can intensify expected benefits (yet in addition increments chances).

Gambles:

- High Unpredictability: Cash costs can be exceptionally unstable, particularly in the midst of political or monetary vulnerability. This unpredictability can prompt critical misfortunes for brokers.

- Influence Dangers: While influence can upgrade benefits, it likewise amplifies misfortunes. Exchanging with high influence requires cautious gamble the board.

- Market Control: National banks and enormous foundations can here and there control cash values through mediations, making an extra layer of vulnerability for dealers.

Conclusion

Forex, or the unfamiliar trade market, is the world’s biggest and most fluid monetary market, where monetary forms are exchanged and trade still up in the air. It assumes a basic part in the worldwide economy by working with exchange, speculation, and cross-line exchanges. While forex exchanging offers potential open doors for benefit, it likewise conveys huge dangers, requiring a decent comprehension of the market and cautious gamble the executives’ systems. For organizations, financial backers, and people the same, remaining informed about trade rates and the forex market is fundamental for exploring global monetary scenes.