Interest rates assume a basic part in the economy, impacting both borrowing and saving choices. They can either help you or work against you, depending upon whether you’re borrowing cash or saving it. In India, interest rates, fundamentally set by the Reserve Bank of India (RBI) influence all, from home credits to fixed deposits, and understanding how they work is fundamental for overseeing individual budgets.

What Are Financing costs ?

Interest rates address the expense of getting cash or the profit from saving it. At the point when you apply for a line of credit, whether it’s for purchasing a house, vehicle, or financing instruction, you are charged an interest rate, which is basically the cost you pay to get that loan. Then again, when you set aside cash in a financial balance or put resources into fixed deposits, you acquire revenue on the sum you’ve saved. This double nature of Interest rates makes them a blade that cuts both ways — useful for savers yet possibly exorbitant for borrowers.

What Interest Rates Mean for Borrowing?

Higher Interest rates on Loan: When financing costs are high, borrowing turns out to be costlier. For instance, if you’re taking out a home credit at 10% interest rate, you’ll pay essentially more in regularly scheduled payments in comparison with a loan having a 7% interest rate. High rates can prevent people and organizations from getting a loan, reducing spending on homes, vehicles, or business extensions. This can reduce monetary action as buyer and corporates hesitate to invest.

In India, this impact is obvious in areas like land and automobile. At the point when the RBI raises Interest rates, home loans become more expensive, putting homebuyers in tight spot. The higher the interest rate, the more troublesome it becomes for borrowers to repay their loans, prompting monetary strain.

Low Interest rates on Borrowing: On the other hand, when Interest rates are low, loan becomes less expensive and more easily available. This can lead to rise of interest for loans, allowing people to purchase homes, put resources into organizations, or assets. For instance, after the Coronavirus pandemic, the RBI brought Interest rates down to support borrowing and stimulate financial recovery. Lower financing costs permitted individuals to get bigger loans with reasonable regularly scheduled instalments, advancing monetary development.

What Interest Rates Mean for Saving

Higher Interest rate on Saving: For savers, Higher Interest rates are great. A higher rate implies you procure more on your investment funds or fixed deposits. For example, in the event that a deposit offers a 7% interest rate, your reserve funds will increase more if the rate were 4%. This can boost individuals to save more, as the profits on investment accounts, fixed deposits, or securities are more attractive. Exorbitant Interest rates can likewise help interest in government plans like the Public Provident Fund(PPF) or National Savings Certificates (NSC), which offer fixed returns.

In India, individuals generally favour saving in financial accounts, gold, or fixed deposits. Higher interest rates make Fixed Deposits an attractive decision, offering ensured returns with almost no risk. As interest rates rise, saving turns out to be really appealing, and people are probably going to deposit more cash in bank accounts or low risk investment avenues.

Low Interest rates on Saving: Then again, low financing costs make saving less appealing. At the point when the premium acquired on investment funds or fixed deposit is low, individuals might look for better yields through less secure ventures like stocks or mutual funds. In such situations, the real profit from reserve funds may also be impacted. For instance, in the event that you’re getting 3% interest on a decent deposit while inflation is at 5%, the genuine worth of your reserve funds is really contracting. This pushes people to investigate alternative investment ventures to safeguard their wealth.

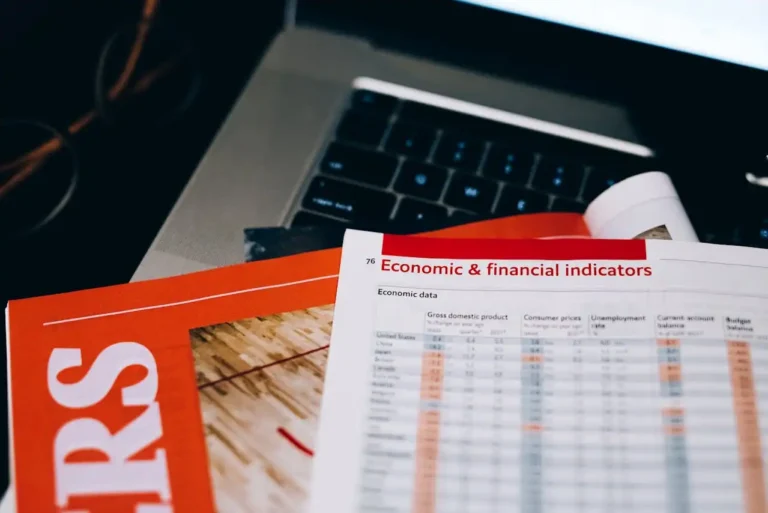

The Job of RBI in Setting Interest rates

In India, the RBI controls Interest rates through its financial strategy, utilizing apparatuses like the repo rate (the rate at which it loans to business banks) to impact way of borrowing and saving.

By changing the repo rate, the RBI can either support or discourage borrowing and saving, contingent upon monetary circumstances. For example, when inflation is high, the RBI could raise Interest rates to minimize spending and control inflation. Alternately, during financial slowdowns, it could bring down rates to stimulate borrowing and investing.

Adjusting Borrowing and Saving

For people, dealing with the effect of Interest rates includes balancing borrowing costs with saving returns. At the point when interest rates are high, focusing on paying off past debts and increasing savings might be a good idea.

Then again, during times of low interest rates, borrowing turns out to be better, while looking for better yielding instruments may be a wise thing to do for reserve funds.

Conclusion

Interest rates are without a doubt a two sided deal — while they make borrowing either costly or cheaper, they likewise direct the profits on investment funds. Whether you’re taking a credit or building an investment funds reserve, understanding how Interest rates impact the two sides of the situation can assist you with pursuing better monetary choices. In India, where financing costs directly affect all, from home loans to fixed deposits, remaining informed is urgent for managing your wealth.