Vehicle ownership is not only practical but can also be a symbol of freedom, achievement, and power to most. Whether you’re dreaming of a sleek sedan, a rugged SUV, or a practical hatchback, buying a car is a significant financial milestone. However, to achieve this – you need a plan and disciplined savings. This is your guide to calculating your budget and starting to save for your dream car using SIP.

Step 1: Define Your Dream Car

Start by identifying the car you want. Explore the brand and model that suits your needs, ranging from work or family car to off-roading. Consider the fuel consumption efficiency, maintenance cost, and insurance amongst other things. Having set your sights on the perfect car, record its on-road price which including ex-showroom price, taxes, insurance, and registration etc.

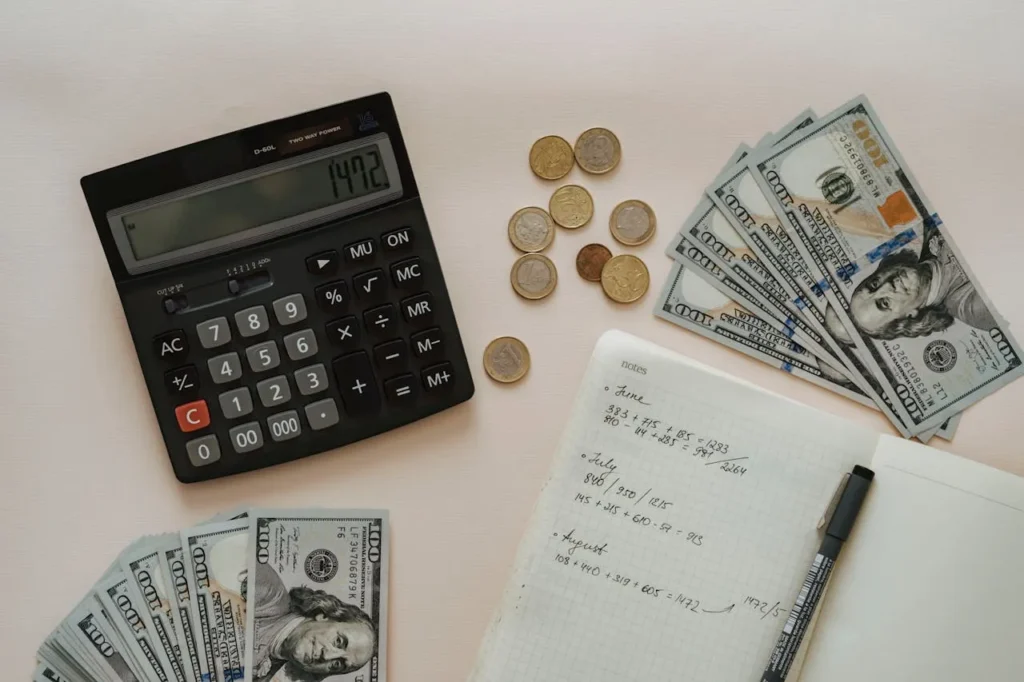

Step 2: Assess Your Financial Situation

Proper consideration about Car should be done prior to finalizing the deal according to current financial situation. Calculate your monthly revenue and track expenses so as to have an estimate of your cash flow. This will allow you to calculate how much of your budget you can put into the car fund, and not end up bankrupt. Also, it will help you see if you can afford to upgrade to a nicer car by stretching some budget.

Step 3: Calculate the Total Cost

Purchase price is not the only cost factor taken into account when an individual possesses a car, there are these recurring costs in fuel, maintenance, insurance, and any loan EMI (earns money instalment) which are part of the bank. The total car-related costs should not exceed the level of 15-20% of the monthly disposable money.

for instance, the vehicle which you wish to buy is ₹8,00,000 in price and you intend to pay a down payment of ₹1,60,000 (after which ₹6,40,000 of the cost will be paid by loan). Use an EMI calculator to derive the monthly EMI on the basis of loan amount, interest rate and term.

Step 4: Set a Savings Goal

Since you have learned the cost, set an attainable target value. Divide the amount into smaller milestones. For instance, if you want to acquire ₹2,00,000 (2 years) for down payment, you need to have an average monthly saving of ₹8,300 approximately.

It could also be possible to capitalize on/invest a sum in a targeted saving account, a periodic deposit or a medium-term mutual fund which will allow your capital to increase for safety. These functionalities can also give you the ability to accrue interest on the balance, while keeping your funds as a liquid asset.

Step 5: Optimize Your Budget

To reach your goal faster, look for ways to cut back on discretionary spending. Restrict going out for meals, curb impulsive purchase, and choose “moderate or low money” gratification. Channel the savings into your car fund consistently.

Step 6: Explore Financing Options

If you’re planning to take a loan, compare interest rates from various banks and NBFCs (Non-Banking Financial Companies). Check whether there are any promotions and rebate for specific cars or any holiday to decrease the car purchase price.

Step 7: Stay Disciplined

Disciplining is the base on which the desired amount for saving can be achieved. Regularly review your progress and make adjustments if needed. Celebrate small milestones to keep yourself motivated.

Conclusion

Saving for the car of your dreams is not only about owning a car but also overcoming a goal that symbolizes your work and your financial discipline. If you can do the math, create a financial plan, and consistently make savings, you can kill the door to your dream car sooner than you thought you could.