Inflation and Deflation are two basic monetary ideas that can fundamentally influence your monetary prosperity. Understanding what they mean remain closely connected for overseeing individual budgets and safeguarding your riches, especially in a unique economy like India’s.

What is Inflation?

Inflation alludes to the general expansion in costs of labour and products over the long run. As costs rise, the worth of cash diminishes, meaning you really need more cash to purchase similar items.

For example, assuming that Inflation is at 5%, a basket of everyday food items that costs ₹1,000 today will cost ₹1,050 in next year. Basically, Inflation reduces the buying influence of your cash on yearly premise.

Reasons for Inflation

Inflation can be understood by different scenarios, for example,

- Demand-Pull Inflation: This happens when interest for labour and products dominates supply, prompting cost increments. For instance, during festive seasons in India, costs of customer merchandise like gadgets or clothing will generally go up because of increased demand.

- Cost-Push Inflation: When costs of wages or unrefined components increment, organizations pass these expenses onto shoppers, bringing about greater costs for them. Rising oil costs, for instance, can prompt expanded transportation costs, which then, at that point, drive up costs for different merchandise.

- Monetary Strategy: When a national bank, similar to the Reserve Bank of India (RBI), expands the cash supply too fast, it can prompt Inflation. More cash available for use implies more individuals pursuing similar number of products, driving costs up.

How Inflation Dissolves Abundance

Inflation can significantly affect your reserve funds and speculations. For instance, on the off chance that you have ₹1 lakh saved in a proper store procuring 6% interest every year, and Inflation is at 5%, your genuine return is simply 1% ! Over the long period, this Inflation destroys the worth of your cash. Regular things become costly, and if your pay or speculation returns stay up with Inflation, you will end up with less buying power.

Moreover, Inflation influences long haul ventures. On the off chance that your retirement reserve funds don’t represent Inflation, the corpus may not be adequate when you really want it most. The cost of fundamental products, medical care, and administrations will be a lot higher when you retire, and a similar measure of cash will purchase you definitely short of what it does today.

What is Deflation?

Deflation is the opposite of Inflation. It alludes to a general diminishing in the costs of labour and products. While lower costs might appear to be useful from the outside, it can have pessimistic ramifications for the economy and for your privately invested Currency. It indicates low interest, as shoppers postpone buying, expecting even lower costs, prompting decreased financial movement.

Reasons for Deflation

- Decreased Interest: When individuals anticipate that costs should fall further, they hold off on making buys, which prompts a decline popular and, in the long run, a drop in costs. This was seen during monetary stoppages like the Economic crisis of the early 20s.

- Increased Stockpile: Exorbitant inventory with no matching interest can likewise prompt falling costs. For instance, a large storage of food grains might bring about lower costs for farmers if demand doesn’t increase in a similar manner.

- Monetary Withdrawal: When national banks diminish the cash supply or while loaning eases back, there is less cash circling in the economy, prompting deflationary tensions.

How Deflation Dissolves Riches

While collapse could appear to be something to be thankful for because of falling costs, it can erode wealth by making wages lower. the costs of products are falling however your compensation is decreased too, your buying power continues as before or reduces. Additionally, in the event that you have advances or different obligations, deflation can make them harder to repay. As cash turns out to be more significant, the burden of loans increases, making it harder to meet reimbursement commitments.

Safeguarding Your wealth from Inflation and deflation

To shield your abundance from Inflation, it’s fundamental to put resources into resources whose profits surpasses Inflation. Land, stocks, and mutual funds are instances of such ventures. Inflation is vital to adjusting risk while as yet borrowing returns above Inflation.

In deflationary conditions, holding Currency might be a more secure choice, as costs are falling, and the genuine worth of Currency increases. A balanced portfolio is supposed to be sufficiently adaptable to changing financial circumstances.

Conclusion

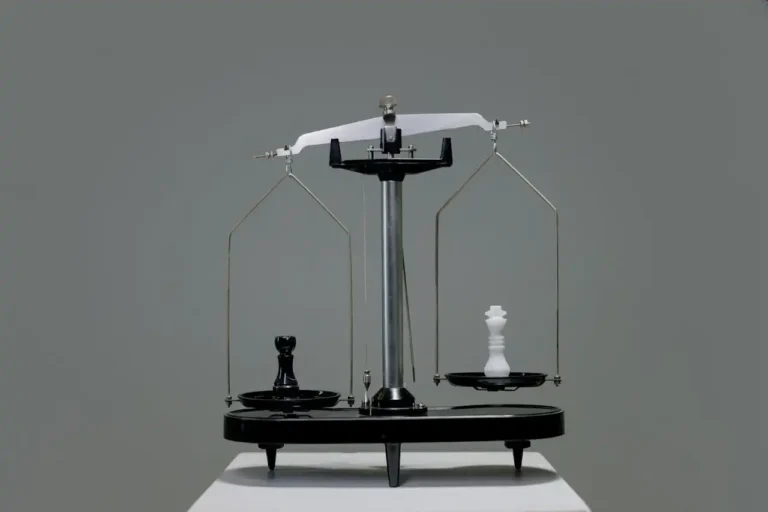

Both Inflation and Deflation may erode your wealth. Inflation diminishes the buying influence of cash, while Deflation can prompt monetary stagnation and expanded obligation loads. By understanding these powers and taking on newer monetary methodologies, you can secure and develop your wealth in spite of the financial environment.